FAQs

Example Payslip

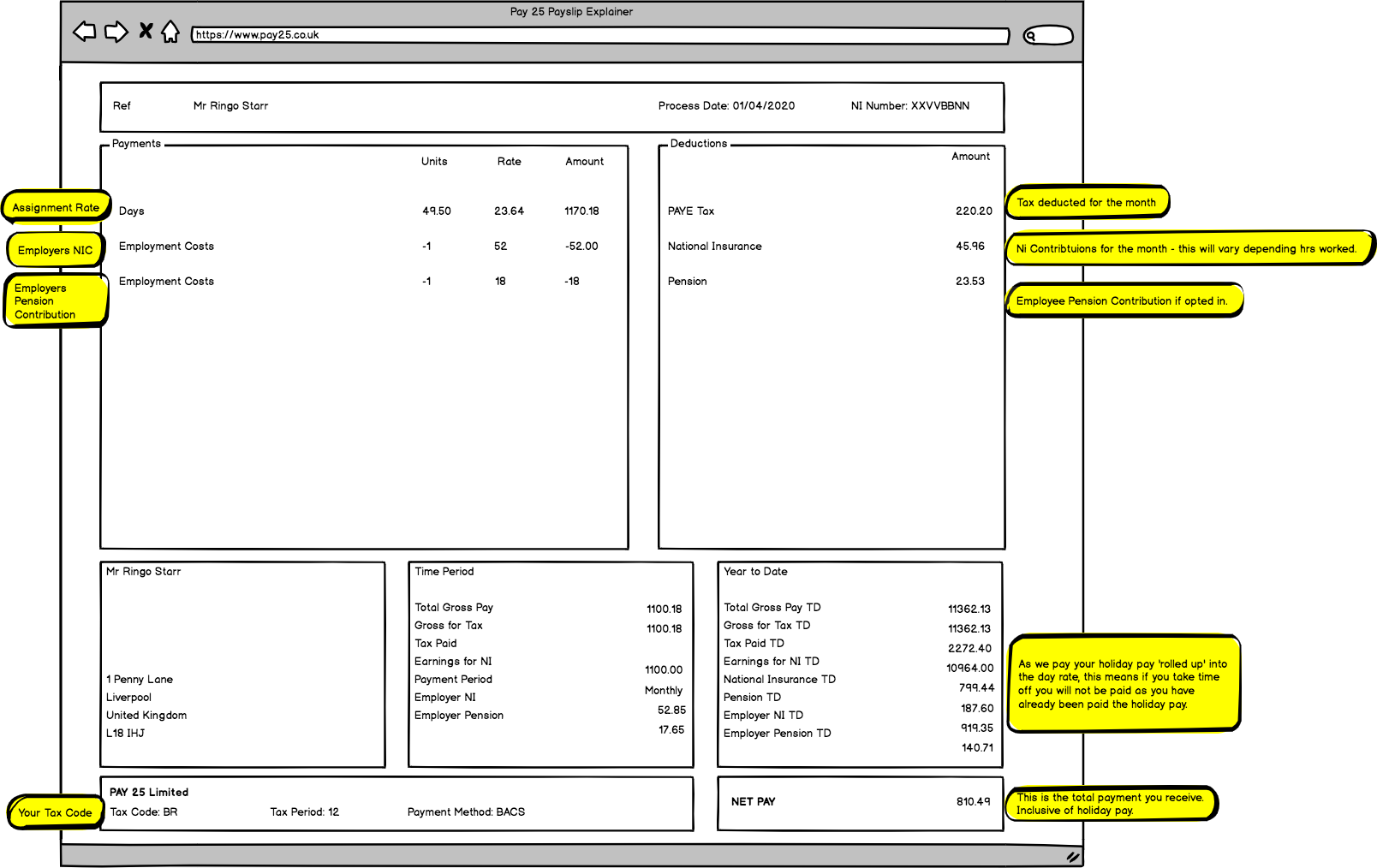

Be wary of online calculators when it comes to payroll. As payroll figures are subject to an individual's tax code being applied. The example below gives an illustrative breakdown of deductions.

Frequently Asked Questions

What is a payroll provider?

Our payroll solution employ you the contractor under a permanent overarching employment contract, supplies you for short-term assignments and processes your paye payroll. It is comparatively cheaper and incurs less administration than setting up your own limited company, particularly if you are not a career temp.

What is an overarching Employment contract?

An overarching employment contract is one where there can be a series of short term assignments in different places, where there can be gaps in assignments, but where the employment contract does not come to an end because of these gaps. The employment contract will make provision for a guaranteed number of hours work offered in any 12 month period and holiday pay.

For these reasons the contract is a full time permanent employment contract.

Can anyone join Pay 25's payroll?

Our payroll solution may be used by any Frame 25 freelancer, or temporary worker, subject to proof of entitlement to work.

What are the benefits of using Pay 25 rather than an Umbrella Company?

Compliance

We established Pay 25 in order to ensure paye contractors are paid correctly, whilst ensuring all paye deductions are applied accurately.

Cost

Unlike Umbrella companies fees are not charged to the contractor.

Insurance

All employees are covered by our insurance policy whilst working on assignment.

Financial Advice

Cube Partners offer reduced fee financial advice, along with discounted tax return services.

Accurate and Prompt Payments

From timesheet submission to approval our average payment terms are 2 days.

Who runs Pay 25?

Our payroll is operated and managed by Cube Partners, a uk-based Chartered accountant.

How do payroll and deductions work?

After submitting your timesheet to Frame 25, Pay 25 will raise invoices for the hours you have worked and any reimbursed expenses to the agency/end client at the appropriate rate(s). These funds become your income. From these funds any processed allowable business mileage and reimbursed expenses, Employers pension contributions, Employers National Insurance contributions and Apprenticeship Levy (if applicable) are deducted to arrive at your 'Gross Salary'.

Your Gross Salary will be subject to tax (PAYE), Employees National Insurance and Employees pension contributions thus providing a Net Salary. Your Net Salary will be paid into your bank account.

Why is my day rate so different to that of a Ltd Company contractor?

This is the amount the agency or end client has agreed to pay your company for your services. The Ltd Company rate is usually higher than the rate an agency would be paying you if they employed you directly or via a payroll provider like Pay 25.

The paye rate is calculated to include the costs of employing you via payroll, including Employers National Insurance contributions and pension contributions.

Why won't an Agency allow me to work via an Umbrella Company I have found online?

This is a common question, and relates to compliance and the criminal finance act

The new Criminal Finances Act was announced in April 2017, and came into force on 30th September. This makes partnerships or limited companies ‘criminally liable’ if they do not prevent their staff, suppliers and clients – or any other ‘external agent’ within the supply chain – from carrying out tax evasion.

Important to note this ‘prevention of tax evasion’ offence can be deemed to have taken place even if the senior management team of the business in question was not involved in, or aware of, the act of tax evasion being carried out.

There are two aspects to the new legislation. Firstly the facilitation of the evasion of UK tax, by any business wherever it is located – and secondly, the facilitation of non-UK tax evasion, by businesses with a UK connection.

HMRC’s aim is to ensure that companies do not ignore the activities of the people they work with, and to make these companies liable for their ‘failure to prevent tax evasion’. If a company is prosecuted and convicted of this offence, there are unlimited penalties which could be applied, so it’s essential that you know exactly how the new legislation works, and that you ensure you are not at risk.

The offence of ‘tax evasion’ itself has not changed, and the same rules apply – when a person or an organisation does something intentionally, which enables them to pay less than their true tax liability, then it is an offence. This means deliberate dishonesty, meaning that a genuine mistake, or even a careless act, would not result in a conviction. These tax evasion laws cover not only personal income tax but also corporation tax, VAT and National Insurance contributions.

Assigning criminal liability

With the new legislation, HMRC has altered the way in which criminal liability is assigned, creating a situation where an ‘associated business’ may be liable for a tax avoidance offence by someone within their supply chain, simply because they were aware of and did nothing to prevent it. It is now much easier for HMRC to convict companies that facilitate tax evasion in some way, even if that is just by not taking full responsibility for ensuring their supply chain is operating in a compliant manner.

This has huge implications for recruitment agencies, which deal with limited company contractors, umbrella companies and contractor accountancy firms. The onus is now on these organisations within the supply chain to ensure that their industry colleagues are not committing, encouraging, or turning a blind eye to tax evasion activity.

What does it mean for recruitment agencies?

As mentioned in the IR35 section there is a long history of tax evading umbrella companies providing loan schemes, annuities and job board schemes. So, while much has been done to eradicate them, no-one operating in this industry can afford to be complacent about the fact that such schemes could still be taking place somewhere within their supply chain.

As an example, an agency would be deemed liable for ‘failing to prevent tax evasion’ if a recruitment consultant encouraged a limited company contractor client to get involved in this type of scheme, when they knew it was set up in order to avoid tax. The agency would also be liable even if an agent was simply aware that a contractor client was involved in this type of scheme, even if they were not involved in encouraging or recommending it. In this situation, a Recruitment Agency would be considered to have ‘failed to prevent the facilitation of tax evasion’.

The only way to avoid criminal liability is to show that the agency has implemented ‘reasonable prevention procedures’.

It is for these reasons why a recruitment agency will typically only work with trusted suppliers, or in our case why we setup Pay 25 to ensure we have visibility and control across our supply chain.

What is Apprenticeship Levy? Why is it on my payslip?

If you’re an employer with a pay bill over £3 million each year, you must pay the apprenticeship levy - this came into law in April 2017.

Pay 25 applies apprenticeship levy where appropriate.

How does holiday pay work?

Pay 25 pay holiday pay rolled up into the contractors day rate from when they start working.

Holiday pay is accrued from the moment you start working. It is calculated at 12.07% of your gross taxable pay.

We pay holiday every time you are paid, so you are always up to date on what you are owed.

Some Umbrella companies will accrue holiday pay and pay this out at a later date.

Glossary of Terms

BACS – The standard bank transfer method (Bank Automated Clearing System). A BACS transfer takes 2-3 working days to clear in your bank account.

Dispensation – A dispensation allows Umbrella Companies to process expenses without having to record them on a P11d form. Without a dispensation, the Umbrella Company would need to ask to see receipts for every expense you claim. It does not dictate the expenses that you are entitled to claim.

Expenses – Certain costs that you may incur, as a direct result of your contract, can be claimed as an expense; these can be claimed in an end of year tax return. Other expenses if approved by the hiring company can be reclaimed directly.

Gross Pay/Income – Your earnings before any deductions for tax, national insurance and any other statutory payments.

HMRC – Her Majesty’s Revenue & Customs (formally the Inland Revenue) is responsible for collecting tax revenue for the government and policing current legislation to make sure companies are compliant.

Self Billing Invoice – A payment request, detailing hours worked and rate, raised after timesheet details have been submitted by the worker.

IR35 – Government tax legislation that took effect in April 2000 to highlight contractors working as a ‘disguised employee’.

MSC – An MSC (Managed Service Company) is a third party service that makes dividend payments to contractors. This type of service became illegal with new legislation introduced in April 2007.

Net Pay/Income – Your earnings after tax, national insurance and any other statutory payments i.e. the amount you receive.

PAYE – Pay As You Earn is a method used to determine the tax and national insurance contributions due on your weekly/monthly earnings.

Same Day Payment – A Same Day Payment ensures that funds will clear in your bank account the same day that they are transferred.

Self-assessment – If you have received earnings other than through PAYE, you will need to complete a self-assessment form and declare your earnings from the previous tax year to HMRC.

Self-billing – If an agency are self-billing, this means they pay directly from the timesheets you submit rather than from an invoice.

Timesheet – A timesheet is used to record the number of hours/days worked and is used by both agencies and end clients. The Recruitment Agency will need a timesheet signed by the client to confirm hours worked before they will issue a payment.

Umbrella Company – An employment services company that enables contractors to receive payments, without the need of setting up and running their own Limited Company. Umbrella companies offer PAYE services which are chargeable to the worker on a weekly basis.