Our Services

We Offer Payrolling for Frame 25 Contractors.

Operated by Chartered Accountants Cube Partners

Using Pay 25

Contractors found to be working on assignments inside IR35, or those looking to join a payroll, can use the Pay 25 to ensure compliance.

Becoming an employee of Pay 25 and joining the payroll means you will be taxed through a standard PAYE scheme.

This means employees pay tax at source.

PAYE

We don’t use loan schemes or enable elaborate expense claims.

National Insurance contributions are deducted as a percentage of earnings, this percentage is identical for all companies. Employer’s NIC’s stands at 15.05% only levied on earnings above £175 per week and is uncapped

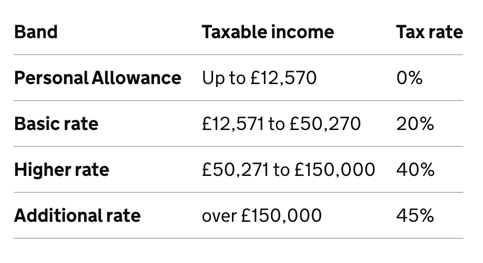

Income tax calculations are more complicated and depend on the individual's tax code.

The latest tax codes are listed below.

For the most current rates - please check the HMRC website.